Asia-US Container Rates Ease amid Low Volume and Rising Blank Sailings, Panama Ports Dispute Escalates

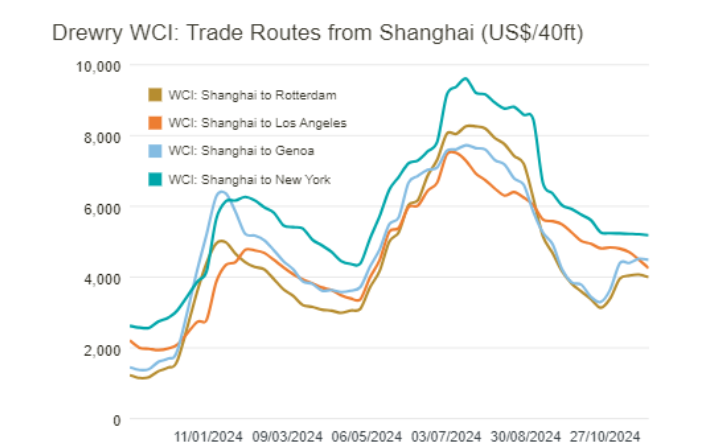

Container shipping rates from East Asia and China to the US edged lower this week as cargo volumes remain soft, despite carriers increasing the number of blank sailings. Supply chain advisory firm Drewry reported that spot rates from Shanghai to major US ports declined slightly due to subdued demand. Ahead of factory closures for the Lunar New Year, carriers announced 57 blank sailings over the next two weeks on transpacific East and West Coast trade lanes, significantly higher than in previous years. Analysts expect spot rates to continue a modest decline in the coming weeks.

Ocean and freight analytics firm Xeneta also reported slight rate drops. Xeneta chief analyst Peter Sand noted that offered capacity on transpacific trade to the US West Coast increased 6.9% in the last week, while average spot rates remained nearly flat. Data shows the mid-low market segment, dominated by high-volume shippers, has fallen 18.3% over the past month, compared with an 11.5% drop in the overall market average.

Online freight platform Freightos highlighted a sharper decline, with West Coast rates falling more than 20% last week to around $1,900 per FEU, returning to early December levels. Judah Levine, head of research at Freightos, cited National Retail Federation projections that March volumes could drop 5% month-on-month, with Q1 demand down 7% year-on-year as retailers adopt a cautious approach.

Global logistics provider Freight Right reported steady rates on its TrueFreight Index (TFX). Founder and CEO Robert Khachatryan said the ocean freight market has cooled as China enters the final working week before the Lunar New Year shutdown, stabilizing rates at previously established lower levels. The Shanghai Containerized Freight Index (SCFI) recorded its sixth consecutive weekly decline in spot rates.

Container shipping remains crucial to the chemical industry, transporting polymers such as polyethylene (PE) and polypropylene (PP) pellets, titanium dioxide (TiO₂), and liquid chemicals in isotanks.

Meanwhile, the Panama ports legal dispute continues as Hong Kong-listed CK Hutchison (CKHH) confirmed it will explore all legal options after Panama’s supreme court annulled its contract to operate ports on both sides of the Panama Canal. CKHH warned global shipping major Maersk and APM Terminals against taking over operations without a formal agreement. The dispute could halt the planned $22.8 billion sale of the ports to a BlackRock-led consortium, amid US concerns over Chinese influence on the canal. The US accounts for over half of transits through the Panama Canal, which remains the key route for Asia-US Gulf and East Coast trade.

Read: Container Freight Rates Slide Sharply as Oversupply Weighs on the Market Ahead of Lunar New Year

US chemical tanker freight rates were mixed this week, according to ICIS. Rates on the US Gulf to Rotterdam trade saw upward pressure due to increased cargo inquiries, while larger parcels edged slightly lower. Dense fog in the US Gulf caused delays affecting laycans and voyage schedules. US Gulf to Asia rates remained stable ahead of the Lunar New Year, with a tight tonnage list supporting firm rates. For US Gulf to India, ethanol and MEG demand strengthened rates, while US Gulf to Brazil rates rose slightly due to limited space and steady COA nominations. Bunker prices also increased following higher energy costs.