Op-Ed: CIPS, Shipping Routes, and the Structural Evolution of Global Trade Finance

By Bahzad Anwar

Global trade is rarely shaped by rhetoric. It is shaped by tonnage, freight rates, port throughput, invoices, and settlement cycles. Long before political narratives emerge, commercial logic quietly determines outcomes. Financial infrastructure, contrary to popular belief, has almost never led trade; it has consistently followed it. From the gold standard to Bretton Woods, and later the rise of a US-dollar-centric settlement architecture, payment systems evolved in response to where goods flowed and how frequently ships sailed, not the other way around. China’s Cross-border Interbank Payment System (CIPS) should be understood within this historical continuum. It is less a geopolitical declaration than a commercial response to a changing geography of trade. As the Bank for International Settlements has repeatedly observed, payment systems tend to adapt to trade patterns rather than redirect them (BIS, 2022).

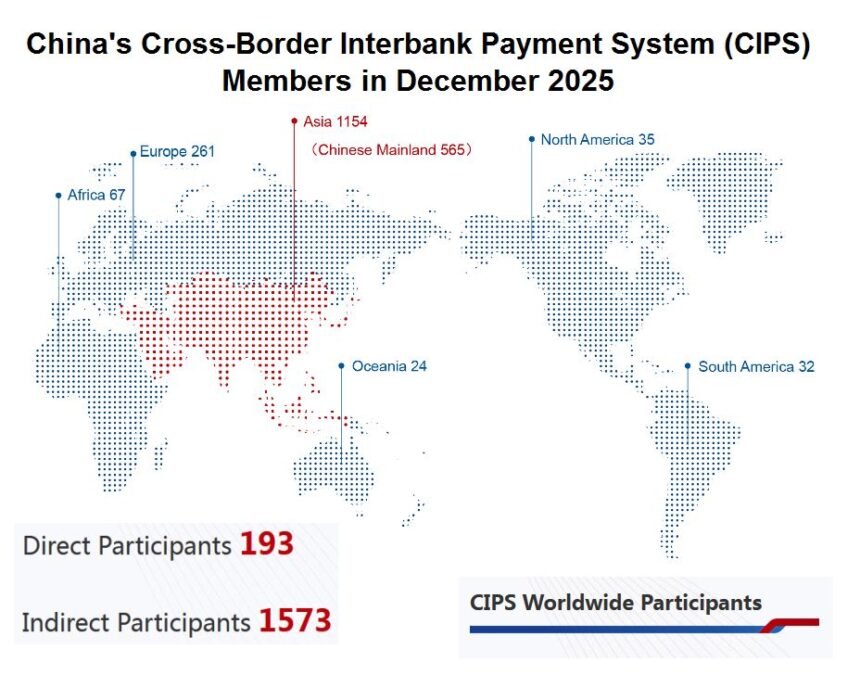

CIPS today connects 193 direct participants and more than 1,500 indirect participants, according to the People’s Bank of China. These numbers are not symbolic; they are structural. Direct participants, typically large domestic and international banks, maintain a direct interface with the system, while indirect participants, often regional or commercial banks, access CIPS through these primary nodes. This architecture closely mirrors global maritime networks. A limited number of hub ports concentrate high volumes, while a wider constellation of secondary ports depends on them for reach and efficiency. Financial systems, like shipping networks, function optimally when scale and distribution are carefully balanced.

On 20 January 2026, CIPS reportedly processed transactions exceeding CNY 1 trillion in a single day, spanning more than 38,000 individual payments. A meaningful share of this volume is linked to maritime commerce, freight settlements, port and terminal charges, bunker procurement, ship chandlery, charter hire, and integrated logistics contracts. Shipping is not a peripheral user of emerging settlement channels. It is among their most consistent and practical adopters. As Asian, Middle Eastern, and African trade corridors continue to expand, yuan-denominated invoicing increasingly reflects commercial pragmatism rather than political preference. Where cargo flows intensify, settlement practices adjust accordingly, a pattern well documented by UNCTAD in its analyses of South-South and Asia-centric trade growth (UNCTAD, 2024).

Maritime trade finance operates on a finely balanced equation. Shipowners, exporters, charterers, and port operators generate demand for liquidity, while banks and payment platforms supply it. Where these forces meet, a functional equilibrium emerges, one that determines whether trade moves seamlessly or encounters friction. CIPS does not displace existing systems at this equilibrium point. Instead, it adds incremental capacity, particularly for trade flows already embedded in Asian supply chains. In doing so, it offers diversification in settlement options and mitigates currency concentration risk for certain routes. As the International Monetary Fund has noted, currency diversification in trade settlement is fundamentally a risk-management decision, not a rejection of dominant currencies (IMF, 2023).

It is essential to state this without ambiguity. The US dollar remains the principal settlement currency in global shipping. The euro retains its central role in regional trade. SWIFT continues to underpin the vast majority of cross-border financial messaging worldwide. CIPS does not dismantle these foundations, nor does it claim to. What it introduces is optionality. Shipping professionals intuitively understand this principle. No serious operator depends on a single trade lane, a single port, or a single supplier. Redundancy is not ideology; it is operational prudence. Settlement infrastructure is evolving along the same logic.

For ship-owners, port authorities, charterers, and logistics providers, the emergence of parallel settlement systems is not about alignment or allegiance. It is about resilience, predictability, and cost efficiency in an increasingly multipolar trading environment. As trade patterns decentralize, payment systems inevitably adjust. This is not a rupture with the existing order, it is a recalibration. And, as history consistently shows, shipping remains at the very center of that adjustment.

Mr.Bahzad Anwar is a finance professional and opinion writer. He specializes in financial systems, trade finance, and maritime commerce, offering informed perspectives on global shipping, cross-border payments, and emerging settlement networks.

The views and opinions expressed in this article are solely those of the author and do not necessarily reflect the views of Maritime Current News.